About Us

Praemia REIM: a key European real estate asset management player

Praemia REIM: a key European real estate asset management player

Praemia REIM designs, structures, and manages long-term collective real estate investments for institutional investors. Praemia REIM manages circa €35 billion in assets, 73 investment funds, and more than 1,300 properties across Europe. Its team comprises 450 employees located in France, Germany, Luxembourg, Italy, Spain, Singapore, and the United Kingdom.

Praemia REIM builds its strategy on strong real estate convictions and a highly selective approach to its Europe-wide investments.

€35

billion of assets under management

73

investmentfunds

41%

individualclients

59%

institutionalclients

1300+

assets

12

countries hosting

Praemia REIM

assets

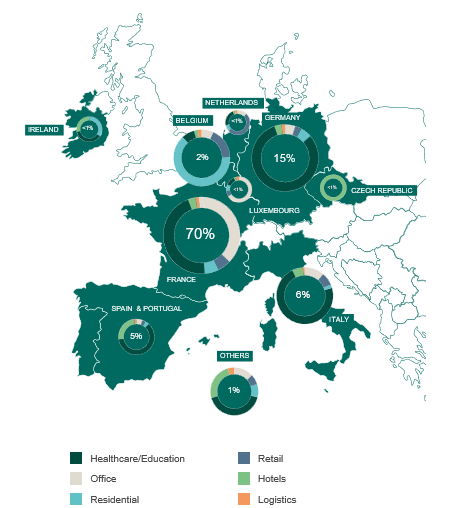

Breakdown by asset class of the real estate portfolio

Figures as at 06.30.2025

Figures rounded to the nearest whole number

Our unique selling points

Our strength lies in our multi-local presence: our teams are central to our business in every country, and are as close as possible to specific markets, to give our clients access to the best investment opportunities in every real estate asset class. We rely on conviction-based management strategies and in-depth knowledge of the various sectors, taking into account macro- and micro-economic trends, the main societal trends (digitalisation, new patterns of use, etc.), and demographic and sociological changes.

A p

Investing across Europe

Investing across Europe

Praemia REIM makes investments in every euro zone country. Our multi-local presence with local operational teams makes it easier to identify the best opportunities and monitor management.

Praemia REIM is able to invest in every asset class (offices, retail, residential/hotels and healthcare/education).

We select high-potential locations and make high-quality investments, while establishing lasting relationships with our tenants.

Praemia REIM is able to invest in every asset class (offices, retail, residential/hotels and healthcare/education).

We select high-potential locations and make high-quality investments, while establishing lasting relationships with our tenants.

Figures as at 06.30.2025 - figures rounded to the nearest whole number

CSR at the core of our value proposition

Our commitment to society and the environment has been part of our history for 10 years.

The investments we propose to our clients reflect the values we share and our Environmental, Social and Governance (ESG) issues in conducting its activities.

The investments we propose to our clients reflect the values we share and our Environmental, Social and Governance (ESG) issues in conducting its activities.

Our ESG Policy is expressed by practical solutions which are transparent and measurable. This is applied at three levels:

Corporate: our commitments towards a more sustainable planet;

Responisble funds: our commitments towards more people-friendly cities;

Property: decarbonising our European real assets.

Corporate: our commitments towards a more sustainable planet;

Responisble funds: our commitments towards more people-friendly cities;

Property: decarbonising our European real assets.

et Firefox

et Firefox